Page 137 - SYU Prospectus

P. 137

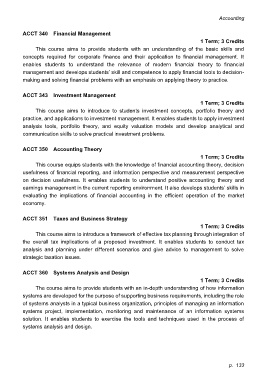

Accounting

ACCT 340 Financial Management

1 Term; 3 Credits

This course aims to provide students with an understanding of the basic skills and

concepts required for corporate finance and their application to financial management. It

enables students to understand the relevance of modern financial theory to financial

management and develops students’ skill and competence to apply financial tools to decision-

making and solving financial problems with an emphasis on applying theory to practice.

ACCT 343 Investment Management

1 Term; 3 Credits

This course aims to introduce to students investment concepts, portfolio theory and

practice, and applications to investment management. It enables students to apply investment

analysis tools, portfolio theory, and equity valuation models and develop analytical and

communication skills to solve practical investment problems.

ACCT 350 Accounting Theory

1 Term; 3 Credits

This course equips students with the knowledge of financial accounting theory, decision

usefulness of financial reporting, and information perspective and measurement perspective

on decision usefulness. It enables students to understand positive accounting theory and

earnings management in the current reporting environment. It also develops students’ skills in

evaluating the implications of financial accounting in the efficient operation of the market

economy.

ACCT 351 Taxes and Business Strategy

1 Term; 3 Credits

This course aims to introduce a framework of effective tax planning through integration of

the overall tax implications of a proposed investment. It enables students to conduct tax

analysis and planning under different scenarios and give advice to management to solve

strategic taxation issues.

ACCT 360 Systems Analysis and Design

1 Term; 3 Credits

The course aims to provide students with an in-depth understanding of how information

systems are developed for the purpose of supporting business requirements, including the role

of systems analysts in a typical business organization, principles of managing an information

systems project, implementation, monitoring and maintenance of an information systems

solution. It enables students to exercise the tools and techniques used in the process of

systems analysis and design.

p. 133