Page 129 - HKSYU Prospectus 2023-24

P. 129

Accounting

the relevant course(s) taken.

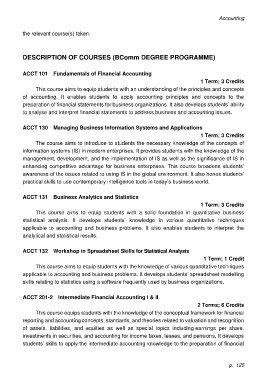

DESCRIPTION OF COURSES (BComm DEGREE PROGRAMME)

ACCT 101 Fundamentals of Financial Accounting

1 Term; 3 Credits

This course aims to equip students with an understanding of the principles and concepts

of accounting. It enables students to apply accounting principles and concepts to the

preparation of financial statements for business organizations. It also develops students’ ability

to analyse and interpret financial statements to address business and accounting issues.

ACCT 130 Managing Business Information Systems and Applications

1 Term; 3 Credits

The course aims to introduce to students the necessary knowledge of the concepts of

information systems (IS) in modern enterprises. It provides students with the knowledge of the

management, development, and the implementation of IS as well as the significance of IS in

enhancing competitive advantage for business enterprises. This course broadens students’

awareness of the issues related to using IS in the global environment. It also hones students’

practical skills to use contemporary intelligence tools in today’s business world.

ACCT 131 Business Analytics and Statistics

1 Term; 3 Credits

This course aims to equip students with a solid foundation in quantitative business

statistical analysis. It develops students’ knowledge in various quantitative techniques

applicable to accounting and business problems. It also enables students to interpret the

analytical and statistical results.

ACCT 132 Workshop in Spreadsheet Skills for Statistical Analysis

1 Term; 1 Credit

This course aims to equip students with the knowledge of various quantitative techniques

applicable to accounting and business problems. It develops students’ spreadsheet modelling

skills relating to statistics using a software frequently used by business organizations.

ACCT 201-2 Intermediate Financial Accounting I & II

2 Terms; 6 Credits

This course equips students with the knowledge of the conceptual framework for financial

reporting and accounting concepts, standards, and theories related to valuation and recognition

of assets, liabilities, and equities as well as special topics including earnings per share,

investments in securities, and accounting for income taxes, leases, and pensions. It develops

students’ skills to apply the intermediate accounting knowledge to the preparation of financial

p. 125