Page 132 - HKSYU Prospectus 2023-24

P. 132

Shue Yan University Prospectus 2023-24

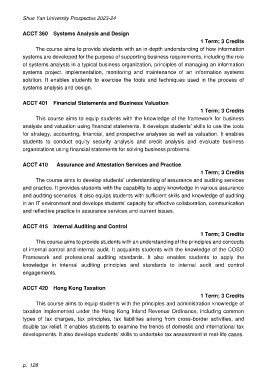

ACCT 360 Systems Analysis and Design

1 Term; 3 Credits

The course aims to provide students with an in-depth understanding of how information

systems are developed for the purpose of supporting business requirements, including the role

of systems analysts in a typical business organization, principles of managing an information

systems project, implementation, monitoring and maintenance of an information systems

solution. It enables students to exercise the tools and techniques used in the process of

systems analysis and design.

ACCT 401 Financial Statements and Business Valuation

1 Term; 3 Credits

This course aims to equip students with the knowledge of the framework for business

analysis and valuation using financial statements. It develops students’ skills to use the tools

for strategy, accounting, financial, and prospective analyses as well as valuation. It enables

students to conduct equity security analysis and credit analysis and evaluate business

organizations using financial statements for solving business problems.

ACCT 410 Assurance and Attestation Services and Practice

1 Term; 3 Credits

The course aims to develop students’ understanding of assurance and auditing services

and practice. It provides students with the capability to apply knowledge in various assurance

and auditing scenarios. It also equips students with sufficient skills and knowledge of auditing

in an IT environment and develops students’ capacity for effective collaboration, communication

and reflective practice in assurance services and current issues.

ACCT 415 Internal Auditing and Control

1 Term; 3 Credits

This course aims to provide students with an understanding of the principles and concepts

of internal control and internal audit. It acquaints students with the knowledge of the COSO

Framework and professional auditing standards. It also enables students to apply the

knowledge in internal auditing principles and standards to internal audit and control

engagements.

ACCT 420 Hong Kong Taxation

1 Term; 3 Credits

This course aims to equip students with the principles and administration knowledge of

taxation implemented under the Hong Kong Inland Revenue Ordinance, including common

types of tax charges, tax principles, tax liabilities arising from cross-border activities, and

double tax relief. It enables students to examine the trends of domestic and international tax

developments. It also develops students’ skills to undertake tax assessment in real-life cases.

p. 128