Page 133 - HKSYU Prospectus 2023-24

P. 133

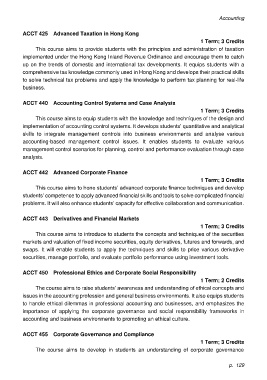

Accounting

ACCT 425 Advanced Taxation in Hong Kong

1 Term; 3 Credits

This course aims to provide students with the principles and administration of taxation

implemented under the Hong Kong Inland Revenue Ordinance and encourage them to catch

up on the trends of domestic and international tax developments. It equips students with a

comprehensive tax knowledge commonly used in Hong Kong and develops their practical skills

to solve technical tax problems and apply the knowledge to perform tax planning for real-life

business.

ACCT 440 Accounting Control Systems and Case Analysis

1 Term; 3 Credits

This course aims to equip students with the knowledge and techniques of the design and

implementation of accounting control systems. It develops students’ quantitative and analytical

skills to integrate management controls into business environments and analyse various

accounting-based management control issues. It enables students to evaluate various

management control scenarios for planning, control and performance evaluation through case

analysis.

ACCT 442 Advanced Corporate Finance

1 Term; 3 Credits

This course aims to hone students’ advanced corporate finance techniques and develop

students’ competence to apply advanced financial skills and tools to solve complicated financial

problems. It will also enhance students’ capacity for effective collaboration and communication.

ACCT 443 Derivatives and Financial Markets

1 Term; 3 Credits

This course aims to introduce to students the concepts and techniques of the securities

markets and valuation of fixed income securities, equity derivatives, futures and forwards, and

swaps. It will enable students to apply the techniques and skills to price various derivative

securities, manage portfolio, and evaluate portfolio performance using investment tools.

ACCT 450 Professional Ethics and Corporate Social Responsibility

1 Term; 2 Credits

The course aims to raise students’ awareness and understanding of ethical concepts and

issues in the accounting profession and general business environments. It also equips students

to handle ethical dilemmas in professional accounting and businesses, and emphasizes the

importance of applying the corporate governance and social responsibility frameworks in

accounting and business environments to promoting an ethical culture.

ACCT 455 Corporate Governance and Compliance

1 Term; 3 Credits

The course aims to develop in students an understanding of corporate governance

p. 129