Page 135 - HKSYU Prospectus 2023-24

P. 135

Accounting

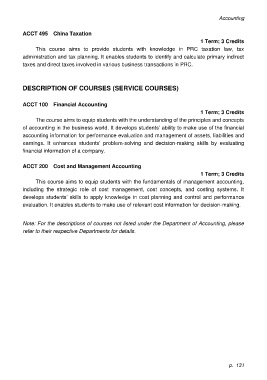

ACCT 495 China Taxation

1 Term; 3 Credits

This course aims to provide students with knowledge in PRC taxation law, tax

administration and tax planning. It enables students to identify and calculate primary indirect

taxes and direct taxes involved in various business transactions in PRC.

DESCRIPTION OF COURSES (SERVICE COURSES)

ACCT 100 Financial Accounting

1 Term; 3 Credits

The course aims to equip students with the understanding of the principles and concepts

of accounting in the business world. It develops students’ ability to make use of the financial

accounting information for performance evaluation and management of assets, liabilities and

earnings. It enhances students’ problem-solving and decision-making skills by evaluating

financial information of a company.

ACCT 200 Cost and Management Accounting

1 Term; 3 Credits

This course aims to equip students with the fundamentals of management accounting,

including the strategic role of cost management, cost concepts, and costing systems. It

develops students’ skills to apply knowledge in cost planning and control and performance

evaluation. It enables students to make use of relevant cost information for decision-making.

Note: For the descriptions of courses not listed under the Department of Accounting, please

refer to their respective Departments for details.

p. 131